Real estate investment remains one of the most lucrative and assured investments you can make. It just requires an investment of time and learning to unlock its true earning potential.

In this guide, we’re going to look at the market of 2020 in detail; the facts and the figures that will shape the market in the days, weeks, and years to come.

If you’re thinking of investing or you already have and would like to be kept up to date with the latest changes, read on.

Introduction To Real Estate Investment

Real estate investment is much like an investment in any other industry or portfolio. It has its risks and rewards and has both low-risk, low-return and high-risk, high-return opportunities.

Knowing what kind of investor you are, what you are looking to get out of the investment, and what kind of real estate you are looking to invest in will be the first big decision to be made.

Types Of Real Estate Investment

There are three major categories into which real estate investment falls. They are residential, commercial, and land. Each bracket also has branching subcategories, and it is highly advisable to pick a niche in which to specialize to stay informed and minimize risks.

Residential Investment

1. Single-Family Rentals

2. Government Subsidized Rental

In the United States, this form of rental is known as a section 8 rental, but there are similar schemes in other countries. This investment is the same as with single-family rentals, with the only exception being that the tenants come from little to no income, and the government will pay all or part of their monthly rent.

These properties can be a guaranteed income source but also come with their specific risks and challenges.

You may get less control and choice in your tenants, and the contracts will be for longer periods with more security and protection for the tenant.

3. Vacation Rental

This type of property is much the same as that of a single-family home but must come fully furnished and available for much short term rental.

To be profitable, this investment works best in areas with significant holiday appeal, such as near to a lake, beach, or major entertainment hub. Having property like this managed by a property management company is much more common.

4. Small Multi-Family

This type of investment includes small apartments and walk-up complexes. It is any property that looks to offer multiple leases under one roof and has the potential for strong capital return if properly managed.

Month-to-month leases are much more common, and so turnover can be higher than with a single-family home, but given the areas these properties are usually found, so is the risk.

5. Fix And Flip

If the wealth of T.V. shows on this type of investment are to be believed, fixing and flipping is an area that provides massive ROI in a relatively small time frame. The basic concept is fairly simple; buy property under-value, add value through investment (upgrade and repair), and then sell for profit. The risks lie in unexpected costs and sudden market fluctuation.

Commercial Investment

1. Retail

Retail property investment is any form of property that will be leased out to more typically B2C businesses. This includes malls, community centers, shopping strips, or larger stand-alone businesses such as a gas station or bank. Investment in this area is more commonly made through a real estate investment trust (REIT).

2. Office

Class A is a high-end office space in a desirable district, where rent is usually above average as the building has a certain amount of prestige in itself. Class B is the most common investment and has the highest level of demand.

Class C is a property with a lower standard of finish in older areas of town with a higher turnover and difficulty in finding tenants and retaining them.

3. Industrial

Industrial real estate means investing in properties used for heavy manufacturing, light assembly, warehouses, and any combination in between. It can be an incredibly stable investment with long tenancies but is one of the most susceptible to tech advancement and sustainability issues.

4. Multi-Family

Multi-family commercial investments are the same as with small multi-family properties but on a larger scale. This includes high and mid-rise buildings, as well as garden-style complexes and manufactured home communities.

The risks and rewards are similar to that of a small multi-family investment, and it is another area where it is more common to invest together with partners or a REIT.

Land Investment

1. Land For Commercial Development

2. Land For Residential Development

Land for residential use is much the same as that used for commercial development. It will require an architect to design and local government to zone. It is common in in-fill areas or by rezoning of other land and undeveloped projects.

3. Land For Farming

Purchasing farmland offers some great rewards as well as significant risks. Farmland can be purchased and then rented out to be farmed to provide income as other development goals are being pursued. There are also significant tax breaks provided by the government for land in agricultural use.

4. Land For Mining

Investment in land where there is access to desirable resources makes for a great multi-generational investment. In the short term, it provides cash flow in leasing directly proportionate to the value of the minerals offered.

In the long term, there is a chance of appreciation in goods when the lease is up, and then when the minerals finally run out, development opportunities arise.

Things To Look Out For When Investing In Real Estate

Investing in real estate, like an investment in any area, has a unique set of risks and rewards. Here are just a few of the things to consider before you decide to invest.

“If you don’t own a home, buy one. If you own a home, buy another one. If you own two homes, buy a third. And, lend your relatives the money to buy a home.”

John Paulson, Investor, and Multi-Millionaire.

Location, Location, Location

It’s the mantra at the heart of the property business, but what does it actually mean?

In the simplest terms, your property’s location is what makes it desirable. Desirability drives demand, and demand sets prices. You could own a mansion in California City that would be worth less than a townhouse in L.A.

If you want to ensure you get the most out of your investment, be sure to pick a home in a central location within your chosen city with good access to roads/public transport.

Choose a good neighborhood with local amenities and services.

A good indicator that it’s a desirable area is how quick the turnaround is on other houses on the market. [1]

The Properties Valuation

A property valuation is a good way to get an idea of its worth. How quickly it will depreciate or appreciate in value is a quick indicator of how desirable the area is.

For existing properties, a common method of valuation is a comparison against similar houses on the market. For new builds, they might tally the total cost against potential depreciation.

Valuation isn’t just important as an indicator of worth, though; it also plays a part in the potential financing options you can apply for and how much, the cost of insurance on the property, and also in the taxes paid. Properties can be over or undervalued, and you should do your own independent research, too.

Related Articles:

Investment Purpose and Profit

You can profit off of property without actually owning any by investing in property construction or property management stocks, or by investing with a group like a REIT.

If you own a property already, you can invest in your own home and make improvements while you live there to boost its appreciation.

Are you looking for a short-term or long-term investment? How much profit would you be expecting to make the high-value investment worth it?

New Construction vs. Existing

New construction can offer some very enticing investment opportunities in both cost and the ease of the sale. You only have to deal with the construction company and also have the ability to customize the property.

The drawbacks are in the fact that there can be delays in completion, a rise in cost due to unforeseen circumstances, and lack of knowledge about the neighborhood and other developments.

With existing properties, the situation is reversed. You will have to deal with realtors or the seller directly, and due to the fees and desire, you are less likely to come across such attractive pricing.

You will have a property valuation to gauge the investment against and can do extensive research on the area and potential future projects.

Loan Leverage and its Pitfalls

In an ideal world, we wouldn’t need to take out a loan or a mortgage in order to invest in real estate. But in the real world, the high-value upfront cost means it’s basically essential.

There are as many different types of loans and mortgages as there are ways to invest in property, and knowing the market and what you are signing up for can help you reap the rewards and minimize the penalties.

Shopping around is essential; don’t take the first deal offered and use other lower interest rates as leverage to get better deals from companies offering other benefits that work for you.

Do you need a fixed rate, floating rate, interest-only, or zero down payment mortgage? Know what works for you before you start doing the rounds.

Why Invest In Real Estate In 2020

We are currently enjoying the benefits of a buyers market in most major cities and markets, which means it’s a great time to invest.

In the United States, according to the Federal Reserve Economic Data (FRED), the median sales price of houses sold has been falling since 2017. [2] Mortgage rates are also down 1% since their highs in 2018 [2], and the stock market is back to an all-time high with the S&P 500 closing at a 28.9% increase in 2019 [3].

“Ninety percent of all millionaires became so through owning real estate. More money has been made in real estate than in all industrial investments combined.”

Andrew Carnegie, Philanthropist.

All this means is that buyers have great negotiation leverage due to the flood of new developments coming into the market and the still all too fresh memory of the market crash. The real estate market this year is set to be higher in supply and lower in demand than usual.

There is also the fact that in America, it is an election year, and across the globe, various other geopolitical situations are causing uncertainty and fluctuation in the market.

This creates a great opportunity for a smart investor.

Best Form Of Real Estate To Invest In

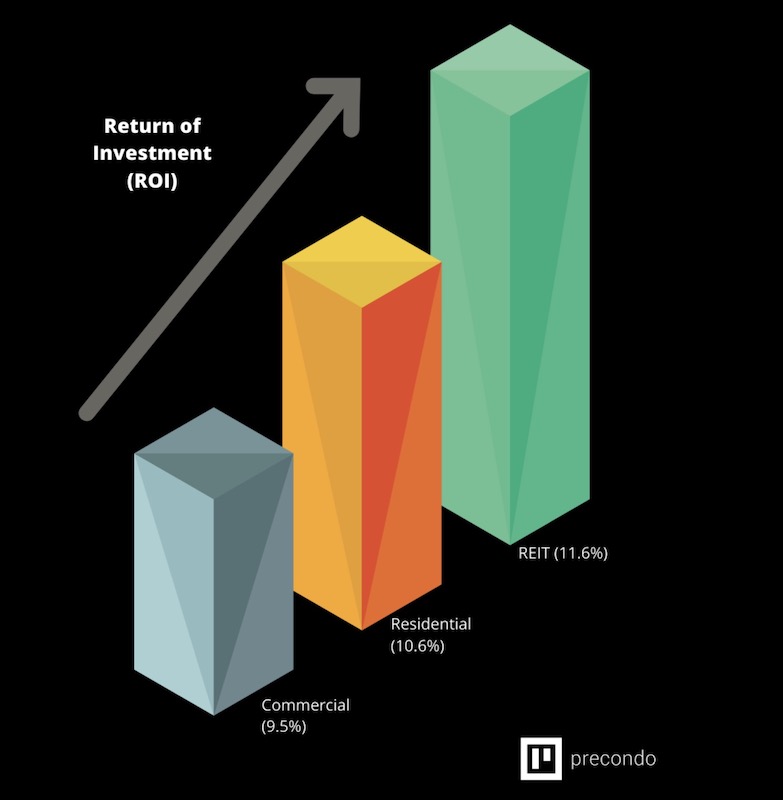

Infographic Source – S&P 500 Index

The return on investment or ROI is the most important factor when considering a large scale investment like real estate. Looking at the average ROI of different types of property investment from across the U.S., you can make an informed decision on what you can expect to get back.

The basic formula for working out the average ROI is to subtract the annual property rental expenses from the annual property income, and then to divide this by the property’s price.

ROI = (Annual Rental Income – Annual Rental Expenses) ÷ Property Price

“Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world.” Franklin D. Roosevelt, 32nd President Of The United States Of America.

This is an average from across the country, and if you’re looking to invest in a specific area or in another country, you should check in on that particular area to get a better feel for the market there.

As a broad indicator, though, it seems that investing in REITs is both the safest and most profitable form of real estate investment.

Real Estate Mortgage Guide/ How To Get Money For Real Estate Investment

There are many different options for financing your real estate investment, but you will be limited by the type of property, the amount you need to borrow, and the acceptable conditions of your investment.

If you are just starting out, you will have fewer choices open to you than if you already have an established portfolio and funds. Here is a brief guide to the most common financing options, but you should look into each option in much greater detail. [5]

Investment Property Mortgages

It works much the same as a traditional mortgage on your first home, although interest rates can be higher and the lending terms more stringent.

You can use conventional mortgages to borrow money for up to four properties at any time.

If you wanted to mortgage the fifth property, you would need to look into commercial, residential real estate loans or portfolio loans.

Government-Backed Loans For Investors

Government-backed FHA or V.A. loans can help new investors purchase their first home or subsequent owner owned properties. They offer very enticing low interest rates and down payments if you qualify.

The main point you’ll need to consider is that in the U.S., at least you must live in the home for at least 12 months and must move in within 60 days of closing. It can be a good option for a long term fix and flip or on larger properties if you live in part and rent out the rest.

Home Equity Loan/ Home Equity Line Of Credit (HELOC)

If you don’t have the liquid assets to finance a new property investment, you can borrow against the equity of your primary residence.

It is a risky prospect as if it goes wrong, and you fall behind on payments, you could potentially lose your home. However, by ensuring that you are not relying on the income from the new property to pay the mortgage on your first home, you can lower the risk.

Commercial Residential Real Estate Loans

Available only to investors who have a few properties under their belt already, these loans can be obtained much quicker provided you can prove you qualify.

With shorter terms and higher rates of interest, some have called this a hard money loan, but the lenders prefer the designation mid-term loan. The profitability of the property you’re investing in and your own property portfolio will be the deciding factor on the terms offered.

Portfolio Loans

You can save time and paperwork by applying for one loan that covers a large investment into multiple properties at once. As commercial real estate loans, the terms can be stringent and the interest high, which will depend on the portfolio presented and the properties proposed.

Peer-to-peer Lending (P2P)

Online P2P loans have been gaining popularity, and they aim to connect borrowers directly with investors.

P2P lending is not for everyone, as you may not be able to borrow all the money you need due to low loan-to-value ratios and a certain degree of marketing required to entice investment.

If used correctly, however, and you have the internet savvy to make it happen, it can generate funds faster than conventional loans and with less red tape.

Best Places To Invest In Real Estate

Following on from the location, location, location rule of real estate investment, certain cities and countries that are more profitable than others.

Let’s take a look at the 4 English speaking markets and which areas within each prove to be the most profitable for investors in the current market.

(Infographic source)

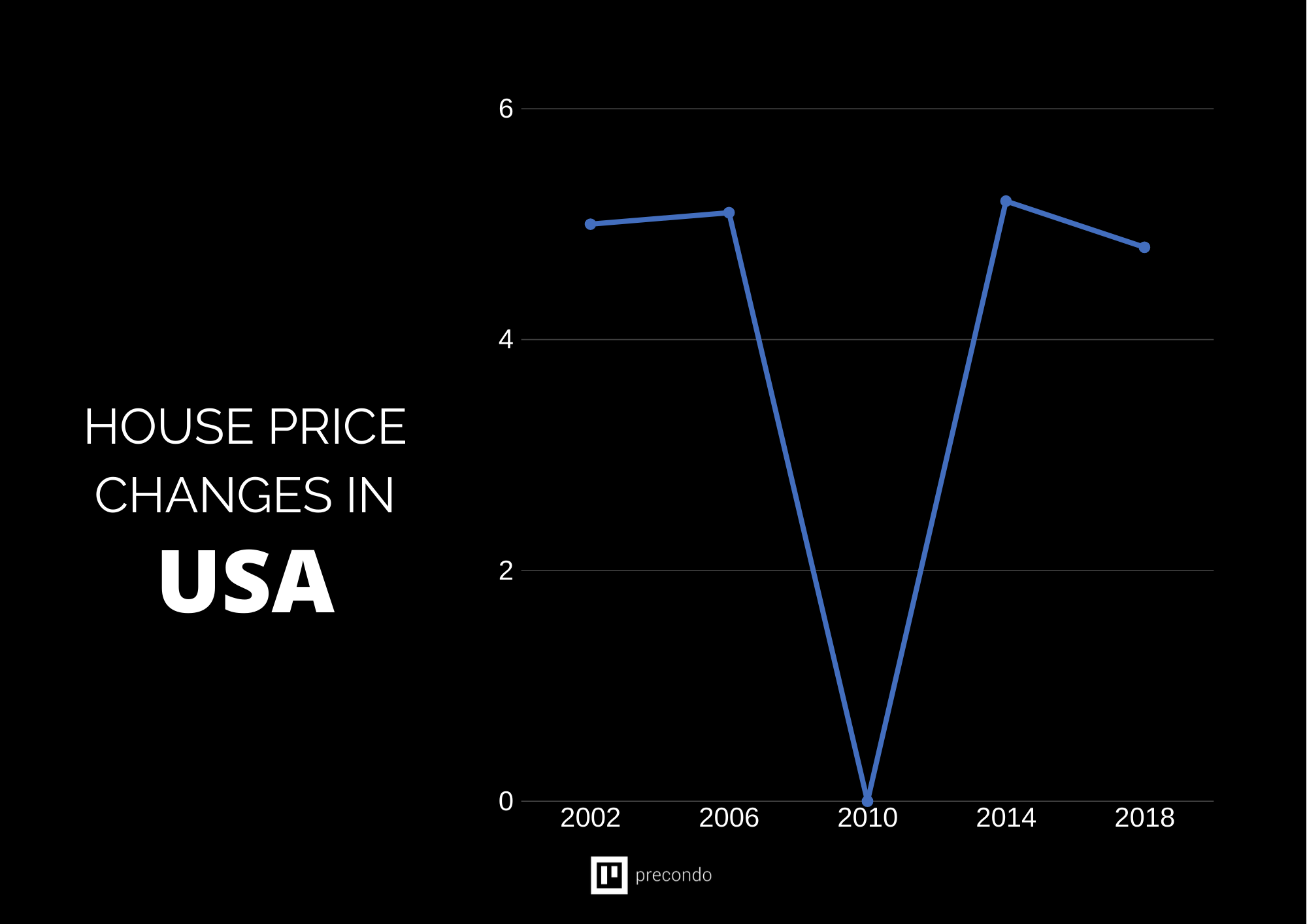

According to the Emerging Trends In Real Estate report from ULI and PWC, which is now in its 41st year, the American real estate market is still very attractive for investors. Nowhere more so than in Austin, Texas. With a low price per square foot and high rental yields, it’s an attractive market for both property owners and landlords.

(Infographic source)

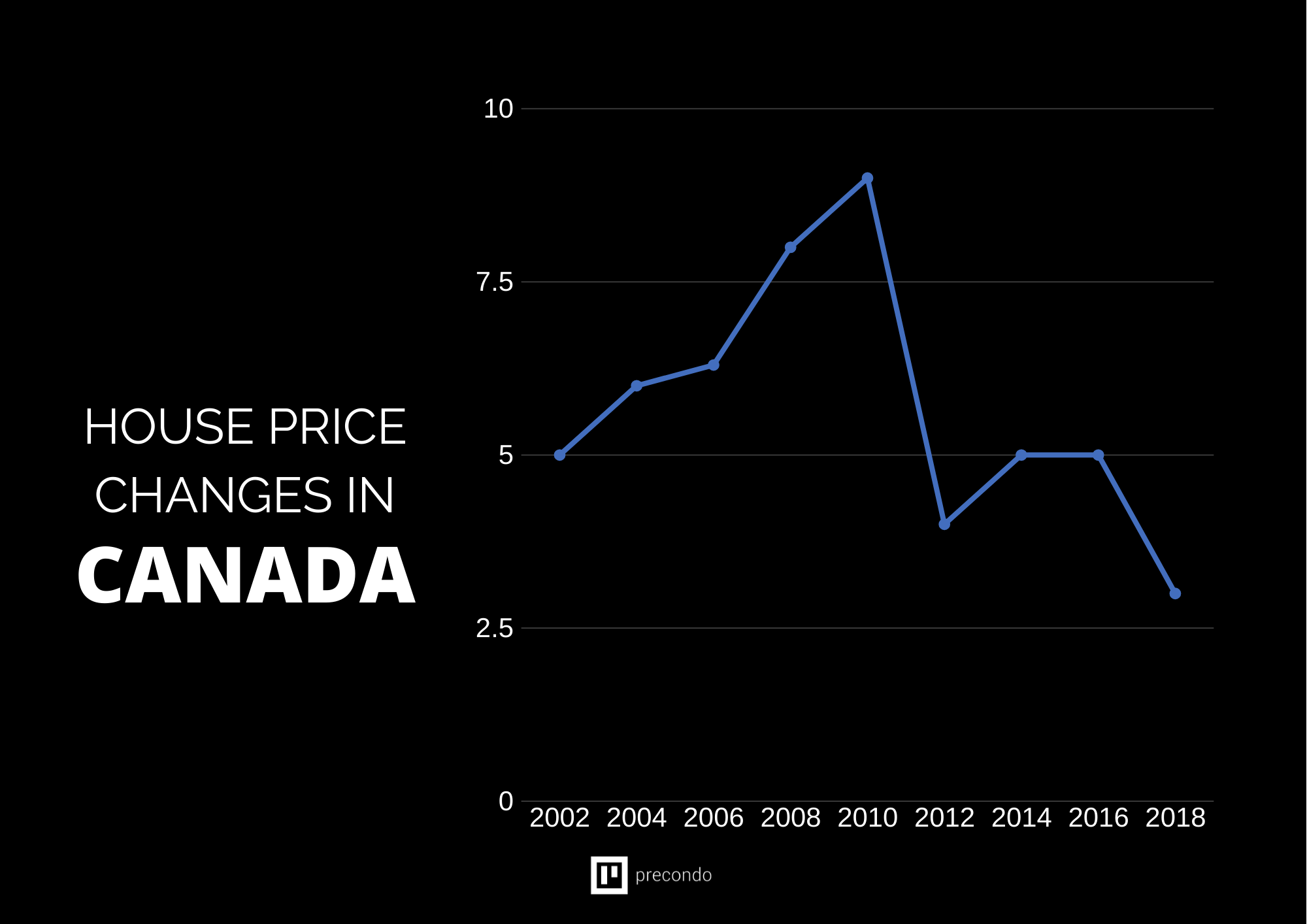

If you’re looking at the Candian real estate market, it’s hard to ignore Windsor, Ontario. A city that used to be the butt of jokes has been steadily working on regeneration and growth attracting investors, and with a five year annual ROI of 11% as well as attractive rental yields, it’s easy to see this trend continuing.

Real Estate investing in Canada has been one of the easiest and most secure investments in the past decades – it continues to out-appreciate the US market while remaining much more stable through times of economic uncertainty.

(Infographic source)

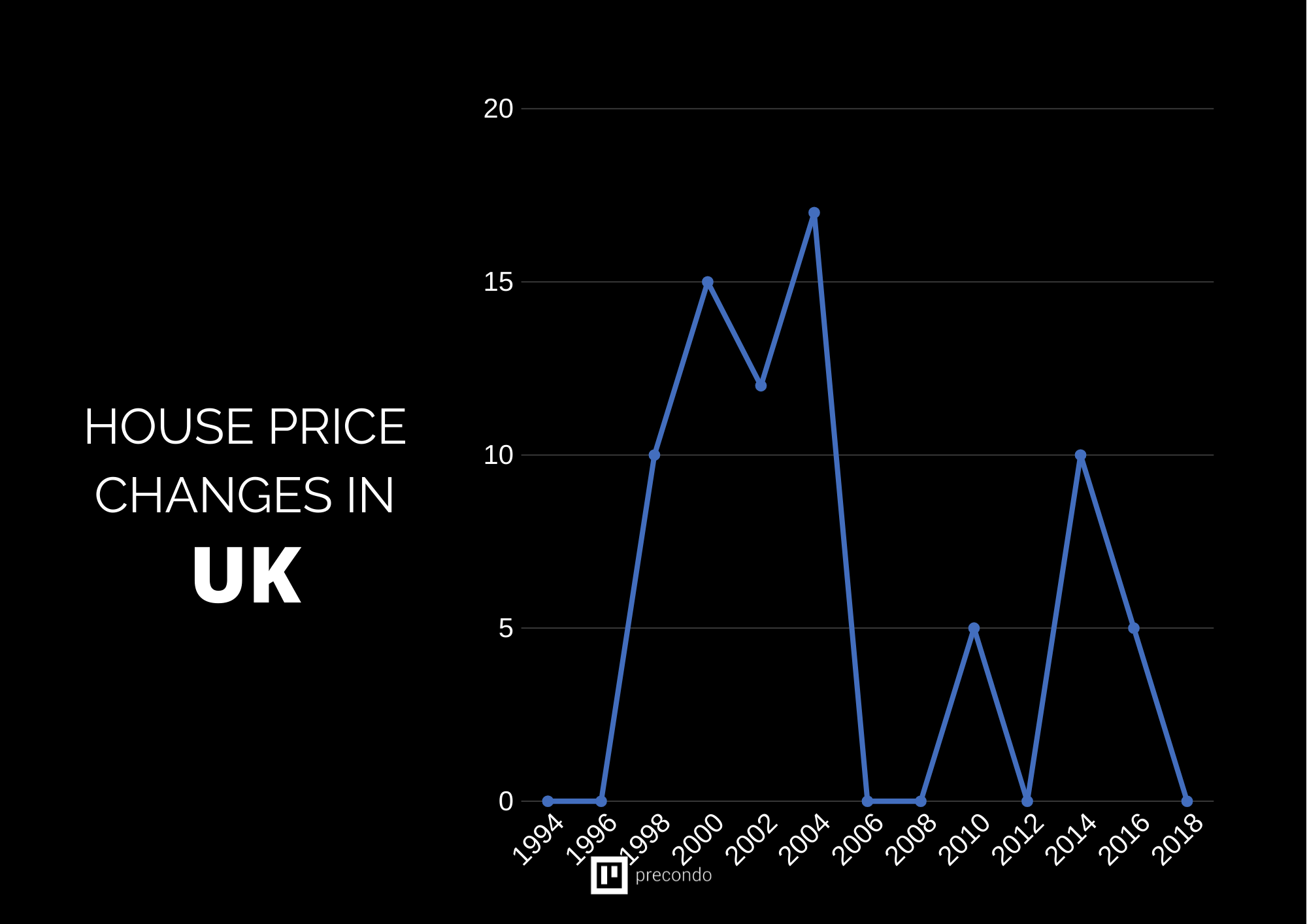

The uncertainty of Brexit has shaken the U.K. real estate market. Looking forward to 2020, we can start to see the shape of things to come. Properties in Liverpool, Birmingham, Cambridge, and Bracknell are all enjoying the boom brought by major regeneration projects driving serious growth. London seems to have slowed down, however, and investing in regional towns seems like a smarter investment.

(Infographic source)

There have been some staggering capital gain growths in the Australian real estate market, especially in mining towns such as Whyalla Norrie, Dysart, and Blackwater. Whyalla Norrie performing the best has seen a growth of 53.6%. Although the volatility of the Perth market in recent years might mean it’s better to make smaller gains on safer areas like Elizabeth Bay, which has seen growth and solid rental yield year after year.

Precisely, where you will be looking to invest will depend on many different factors and the type of investment you’re looking to make, but the above infographics can provide an introductory insight into the places you might want to consider.

If you are open to investing further abroad, there are also many other countries to consider growing markets and excellent potential for return, such as Panama or Brazil. [7]

(Source)

The U.S. housing market has just enjoyed six years of strong growth but is cooling down a little now. Despite this, major cities are still seeing minimal growth, and the market looks to be quite boring in the coming years, which means stability.

(Source)

Canada has been enjoying an unprecedented boom in prices, which is also looking to slow down going into 2020. Demand is falling, and sales are plunging. There are markets that are still seeing good growth, but overall, you need to invest wisely.

(Source)

It’s hard to really get the pulse for the U.K. market from out of the uncertainty of Brexit. House prices are rising, but only nominally. Again, there are specific markets and regions enjoying good growth, but overall it seems stable but in decline.

(Source)

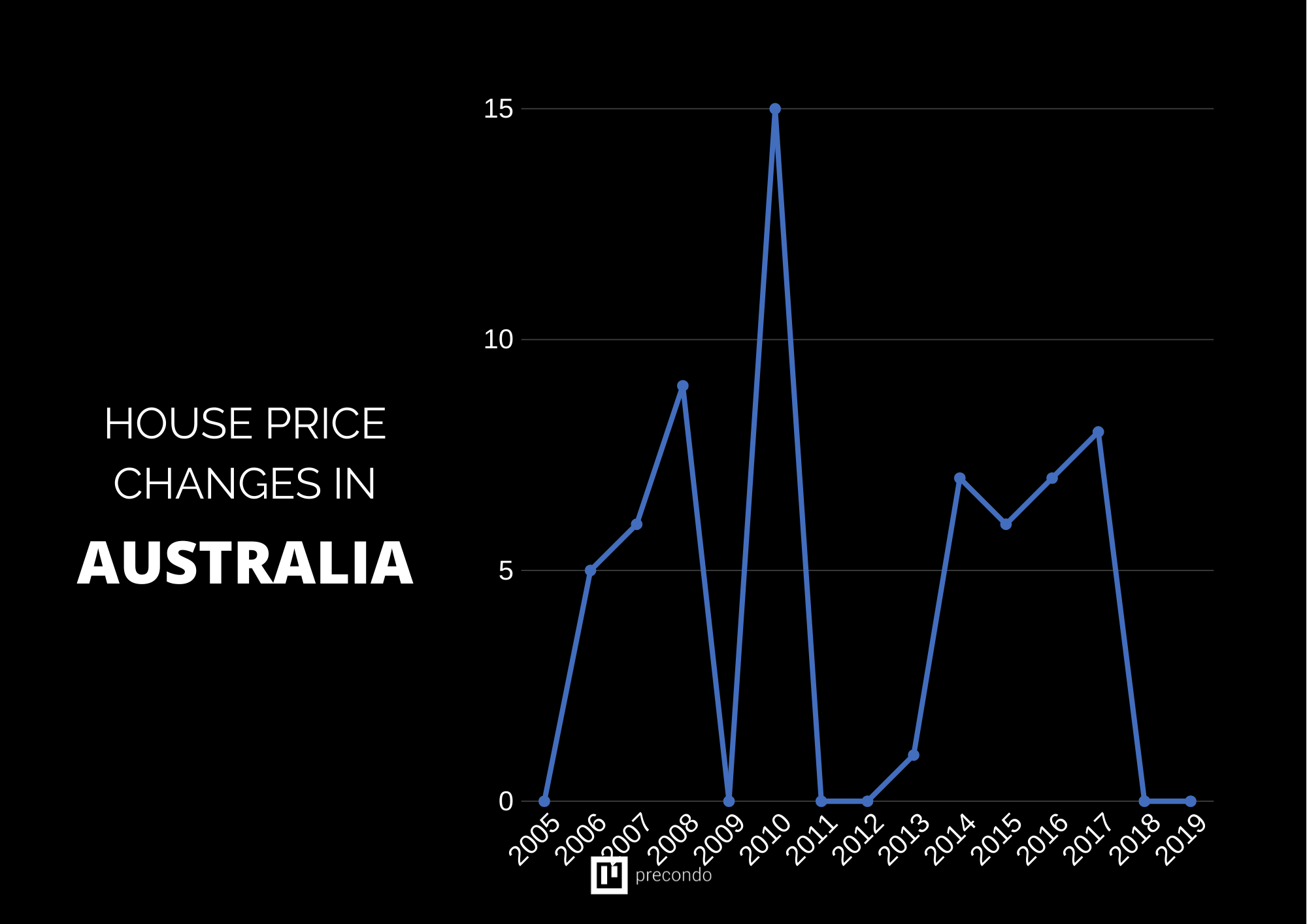

After six years of strong growth, the average house price in Australia is now in sharp decline. This is largely due to measures taken by Australia to cool the market, such as stricter lending measures and taxes on foreign investment.

Importance Of Real Estate Insurance

Real estate may be the biggest investment you will make, and so it follows that you would want to protect that investment.

Insurance doesn’t just cover the obvious damage to your home that can happen by accident or act of God; it may also include liability coverage if your property causes damage to neighboring homes or persons, damage caused by tenants, or court fees for removing bad tenants.

It’s something you need to have, below is a list of some of the best real estate insurance companies to go to. [8] [9] [10] [11]

USA

- State Farm Group

- Berkshire Hathaway

- Allstate Insurance Group

- Liberty Mutual

- Progressive Insurance Group

Canada

- Intact Group

- Aviva Group

- Desjardins Group

- Lloyds Underwriters CAB

- Co-operators Group

U.K.

- John Lewis Finance

- Saga

- LV=

- Churchill

- M&S Bank

Australia

- Vero Insurance

- Allianz Australian Insurance Limited

- QBE Insurance Limited

- Insurance Australia Limited

- Insurance Manufacturers Of Australia P.L.

Current State Of Foreign Real Estate Value

Foreign investors play a significant role in determining and driving the value of the real estate, and the effect is not limited to expensive homes but trickles down throughout the market.

The correlation can easily be observed in some of the infographics below and in average real estate prices, but the direct impact varies region to region.

State Of Foreign Investment In Real Estate [12] [13] [14] [15]

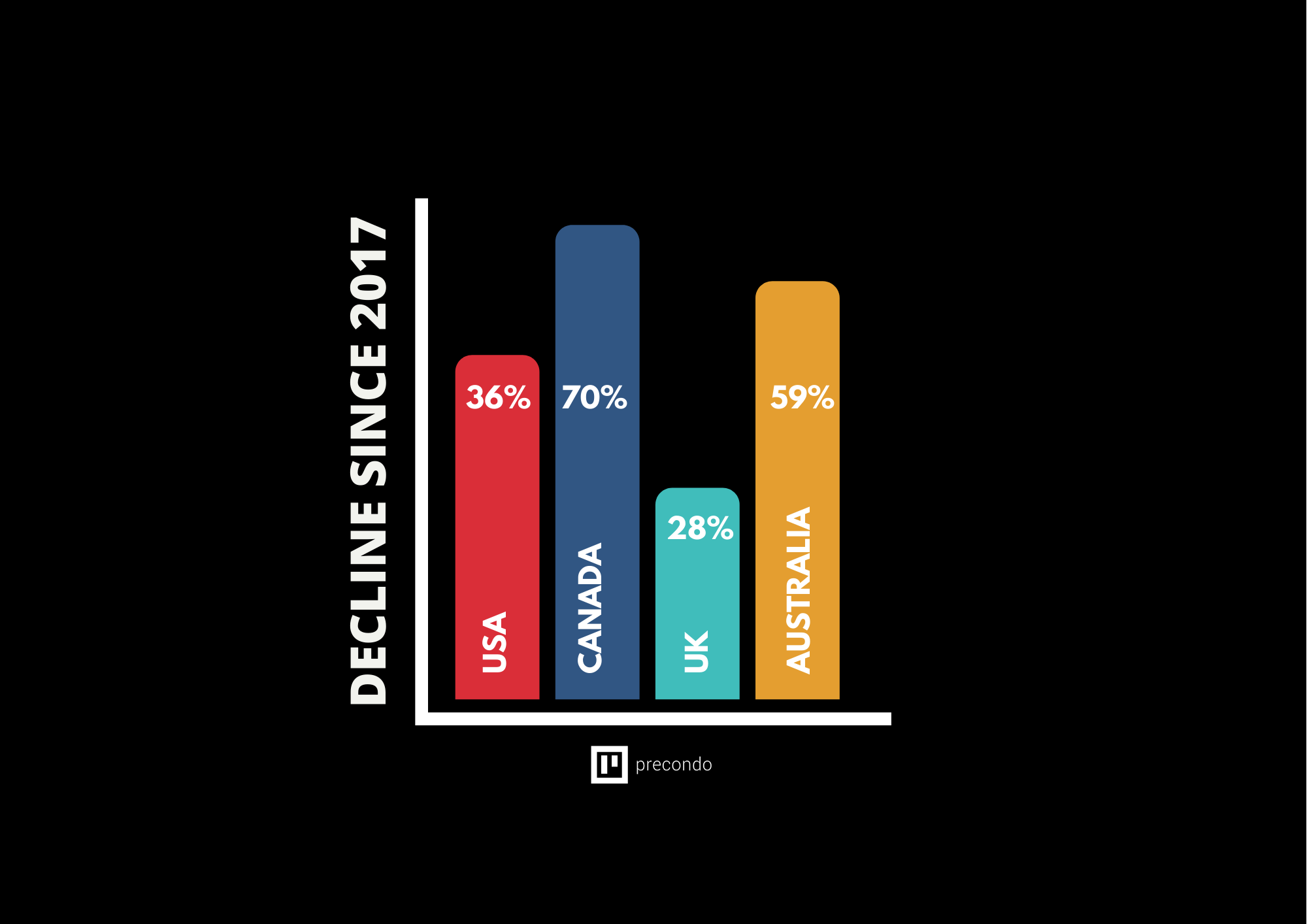

Donald Trump has caused foreign investment in U.S. real estate to plummet by 36%. This is due to stricter visa clampdowns, tariffs, and xenophobic rhetoric. The primary driver of the decline is the drop in Chinese investors who had been the largest investors for the past seven years.

Following the trend in the cooling market mentioned above, foreign investment has seen a sharp 70% drop in the first half of the year if you compare 2018 to 2019. This is largely due to the fact that the most attractive properties for investors, such as top-tier office spaces and rentals in suburban areas, are in short supply.

Brexit absolutely crippled the U.K. real estate market in terms of financial investment as shown by the 2019 values dropping almost 28% from 2017 foreign investments, with foreign investors even using the term ‘Brexiety.’ Now that the future is starting to seem more secure and we’re slowing getting more answers on what’s to come next, it may see growth.

Australia’s foreign investment seems to have been in free fall too. Since the property market bubble burst back in 2017 and owing to the very strict regulations that Australia imposes on foreign investors owning property, there has been a steady and sharp decline in interest with about 59% decline from 2017 to 2018.

How To Increase The Value Of Real Estate

Land

Any way that you can improve the convenience and accessibility of the land for your investor will also command higher valuations. This can be as simple as making sure it is literally easy to access by road, or as in-depth as making sure it has drainage and utilities such as water, electricity, and internet.

House

There are lots of low-cost ways to improve the value of your real estate.

Make sure it is clean, and all the rooms have a fresh coat of paint. Add curbside appeal by having the roof and outside fascias cleaned and make any garden or driveway attractive with a few plants and well-kept lawns.

In the mid-cost range, you should look to insulate to make it soundproof and also more energy efficient. You can also easily add square footage by converting an attic, basement, or garage into a livable space.

Things to consider when looking to add more value to a property is making sure you don’t over-improve.

Check the market and don’t overshoot your target buyers — a diamond chandelier in a suburb cul-de-sac isn’t going to increase the price of the home.

You should also be sure not to spend more money on repairs and renovation than you are going to get back in sales value. The metric to gauge this is the after repair value (ARV), which means you should only pay 70% of the after repair value for the property.

Here you can find out more information about ARV of real estate in Canada.

Condo

If you’re looking to completely renovate or redesign a condo or a house, start with the bathroom, which is typically much smaller in condos. Another huge improvement would be finishing an attached attic or basement, which will add to the homes square footage.

New appliances for the kitchen and painting or touching up the walls and floors are both relatively low-cost improvements that help more than most give them credit for.

FAQs

Can I invest in real estate with no money for a down-payment?

You can invest in real estate with no money for a down payment in a limited capacity. Typically you’ll only get vendor take-back (zero down) on property improvement joint ventures (J.V.’s). This only works in slow markets on dilapidated properties, but not in rapidly appreciating markets.

What’s more important, appreciation, or cash-flow?

Whether appreciation or cash-flow is more important depends on the style of investment you’re after. If you are looking for a consistent monthly income, you are a cash-flow investor. Unfortunately, the properties with the highest rental yield are also the properties with lower appreciation.

If you’re looking to retire rich, you’re a capital gain investor and appreciation may be much more important than monthly income.

Should I buy a new build or an existing resale property?

You should consider buying new build properties over an existing resale property only if you’re a seasoned investor who already owns a property or two. If you’re a first-time investor, then you should consider resale properties as the more viable option. This is due to the mortgages available and the amount of money that needs to be put down upfront.

Should I pay for real estate with cash or get a mortgage?

When deciding whether to pay for real estate with cash or mortgage, you can secure a much better return on your investment by leveraging other people’s money. For example, if you invested $300k in a single property in cash, there is great potential that with smart investing of that same amount with additional mortgages on multiple properties could significantly improve the returns.

I want to flip houses, where are the best returns for flippers?

If you are looking to flip houses for the best returns possible, you need to follow the 70% rule. The rule dictates that you should only pay 70% of the after repair value (ARV) of the property minus the estimated repair costs. This can help to minimize risk and ensure the investment is worthwhile.

Conclusion

Investing in real estate has built the fortunes of many millionaires and insured the financial security of even those amongst us just looking to own our own homes. With populations only looking to grow and demand set to continue to escalate, it is one of the few investments guaranteed to appreciate over time.

Knowing the basics before you invest such a large amount of capital is essential, and there is always more research to be done.

Using this guide, you can get off on the right foot, but dialing in the specifics of the property, area, and type of investment you’re looking to make will be the best indicator of just how much money you profit you may be able to turn.

Did you enjoy this article? See Precondo’s homepage for more information on properties for sale, rent and pre-construction properties.

References

- https://www.financialsamurai.com/is-2020-2021-a-good-time-to-buy-real-estate/

- https://www.washingtonpost.com/business/2020/02/06/fixed-mortgage-rates-hit-three-year-lows-may-be-headed-higher-soon/

- https://www.cnbc.com/2019/12/31/dow-futures-last-trading-day-of-2019.html

- https://www.investopedia.com/financial-edge/0410/the-5-factors-of-a-good-location.aspx

- https://www.fool.com/millionacres/real-estate-financing/articles/6-ways-finance-real-estate-investments/

- https://www.biggerpockets.com/guides/ultimate-real-estate-investing-guide/real-estate-financing

- https://www.liveandinvestoverseas.com/real-estate/10-best-places-to-buy-real-estate-overseas/

- https://www.investopedia.com/articles/active-trading/111314/top-10-insurance-companies-metrics.asp

- https://www.insurancebusinessmag.com/ca/news/breaking-news/these-are-the-top-10-propertycasualty-insurance-companies-in-canada-179800.aspx

- https://boughtbymany.com/news/article/top-10-home-insurance/

- https://www.statista.com/statistics/408355/leading-nonlife-insurance-companies-australia/

- https://www.statista.com/topics/4455/foreign-property-investment-in-the-us/

- https://www.bnnbloomberg.ca/foreign-investment-in-canadian-commercial-real-estate-slides-70-1.1318744

- https://voxeu.org/article/effect-foreign-investors-local-housing-markets-evidence-uk

- https://www.rba.gov.au/publications/bulletin/2014/jun/pdf/bu-0614-2.pdf