How do I get a mortgage on a pre-construction condo? When do I start the process for the pre construction condo buying?

Dull as it may be, financing on pre-construction condo is the very stilts that this entire industry is founded on. Leveraging financed assets is how the rich get richer – and in Toronto, it’s more profitable than ever before. We as the consumers pay as 20% occupancy deposits to own the rights to 100% of an imminent asset according to the deposit structures mentioned in the Condominium Act.

As such, we enjoy the profits of capital gains resulting from leveraging the property market five-to-one. Similarly, condominium developers take our 15-25% deposit as per their typical deposit structure, in addition to some funding from the banks, to fund construction and ultimately deliver on the condo or asset.

Your investments need to be timed accordingly to your debt-to-service ratio, or you can find yourself in a tricky spot with properties you cannot afford to close on – or banks that refuse to honor their mortgage pre-approvals.

Luckily, pre-construction condos in Toronto have been in a seller’s market for 3 straight years now – so liquidating at a profit is easy enough. As a rule of thumb, you want to ere on the side of caution and play the long game.

Here are the top 9 frequently asked questions about mortgages when buying a pre-construction condo.

Do I need a mortgage approval to make a pre-construction purchase?

Yes. This is a safety measure put in place to help curb speculative investment from over-leveraged parties. Also, it ensures that the purchasers can afford to close on the property when the time comes, rather than to default.

There are some exceptions to this rule. Occasionally, when a building has hit the 80% sold mark and funded construction, or when the building is at the end of occupancy period, the builder may loosen up on financing restrictions.

Condo developers in Toronto will generally want this mortgage pre-approved in 30-90 days after you purchase a new condo. However, it is in your best interest to get the pre-approval during your 10-day cooling off period. You can get a commitment letter to secure today’s interest rate for a closing a couple of years out.

What factors affect my eligibility to get a mortgage?

There are a lot of factors that can affect not only your financing eligibility but also the interest rate.

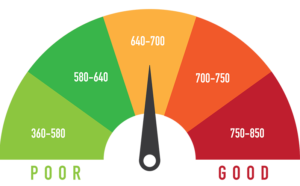

a. Credit Score

An excellent score is anywhere above 700. Below 700 credit rating is still plenty enough for a B-Lender, so don’t count yourself out if you have less than excellent credit. Regardless, the process of getting a mortgage is much easier when you have the ideal credit score.

b. Income to Debt

Income to debt is just a ratio of putting your debt service as a percentage compared to your income. For a simplified example, if you earn $10,000 per month and you have a $1000 school loan payment and $2000 as mortgage payments, you are at 30%. This means that of your monthly income, 30% covers your debt repayments.

Every bank is different. Speaking in generalities, you’ll have trouble attaining financing if the mortgage rates will put you above 40% total debt to service. For investment units, banks will apply 50% of the rental income you receive against your debt repayment so that the qualification metrics may be much lower. Thus, have a tenant secured before the final closing on your investment condo before your mortgage starts.

c. Self Employment or not enough income history

As a self-employed individual, it is notably more difficult to secure a mortgage loan. The nature of being self-employed is that income fluctuates yearly. So, the standard is for banks to use the previous 2 years notice of assessments. They then average them out as your “annual income” figure to use in the TDS calculations.

This raises issues if your business is recently doing very well, as they won’t use the current year’s income numbers. Furthermore, if you haven’t been employed very long at your income level, the bank won’t look at it as a stable source of income. Because of this, it’s best to wait until you’ve settled at least six months before applying for a mortgage.

Do banks offer Rate Guarantees for a year or longer?

If you are purchasing a pre-construction condo that is closing 3+ years out, it is doubtful for the bank to honor the interest rate quoted on your mortgage pre-approval. In these cases, I typically tell clients to get the MPA from the easiest source (usually the bank you’ve dealt with longest) and re-visit a broker at the closing date to shop around for alternative lenders.

If you are purchasing a condo that will be ready in 2 years or less, seek a commitment letter if you want the security of a rate guarantee. It locks in today’s interest rate if the development is already under construction.

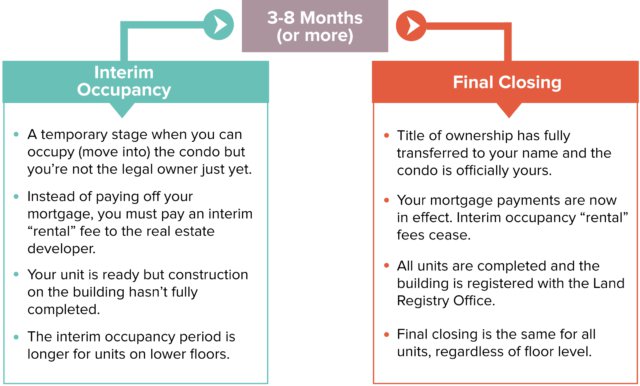

When does the mortgage payments start on a pre-construction unit?

You start making mortgage payments on the final closing costs, not on the occupancy fee. Generally, the occupancy periods are 3 to 6 months before the final closing date. Final closing is when the condo building is officially registered with the city and when you’ll receive the title to your pre-construction condo unit. Closing costs include development levies, warranty fees, legal fees and land transfer tax.

Instead of your mortgage, you’ll have to pay the builder occupancy fees from the time of occupancy to final closing.

How do you calculate occupancy fees on new condominiums?

When your mortgage loan starts, you’re seeing appreciation in the market with even less overhead. The fees comprise 3 things:

- Condo Maintenance Fees

- Property Taxes

- Interest on the capital borrowed based on the BoC rate (for example, if you put 20% as down payment, it’ll be the BoC interest rate on the remaining 80%)

Does a mortgage pre-approval guarantee pre-construction condo financing?

No, it does not. A mortgage pre-approval is typically valid for a period of 90-120 days at maximum, at which point terms would need to be re-negotiated.

It’s simply the builders’ way of hedging their risk and stopping speculative investors.

What are Micro Condos? Will banks mortgage them?

Micro units are any condo units that are under 500 square feet in internal size. Most studios and some of the smaller 1 bedroom units fall in this category. The big-5 banks generally don’t like to mortgage anything under 500 sq.ft, so you may have to turn to alternative lenders to get this done.

As our market continues to appreciate, the affordability of 350-450 sq.ft studios is increasingly attractive to first-time buyers and investors alike, but, for the time being, you may be asked to put down more than 20% or pay higher rates.

Should I use my bank or go to a mortgage broker?

Go to a broker. You may, and often do, get a better rate by using a broker with a solid track record and going with a different bank. Keep in mind a broker will generally work much harder for your commission than the bank you’ve been banking at for years.

Can I pull equity out of my condo project to invest in more condos?

Absolutely. Instead of refinancing, I’d typically recommend going the route of a home equity line of credit (HELOC) which will allow you to get a line of credit based on the capital appreciation of your home.

For example, if you put 20% down on a $400k pre-construction condo, and at the time of closing its assessed value is $500k, you can get a line of credit for the $100k in capital gain.

Any questions? Get in touch with our sales representative at Precondo if you are buying a pre-construction, new condo or a resale unit. Our real estate professionals will explain to you about the closing costs, home inspection fee, utility hook up fees, purchase process, assignment fees and more.

Hey Jordan,

Great article. Say I’m interested in a predevelopment condo being built for 2022. On top of the incremental 20% deposit I would put down, your saying I would also be paying occupancy fees (property tax, condo maintenance fees, etc) every month until the final closing 6 months or so before occupancy at which time the mortgage payments would then be added on?

Thanks,

Manvir