Alright, time for a quick condo market recap.

I’m going to quickly touch on today’s metrics – sales prices, volume, and supply.

We’ll then bust out our crystal ball here and talk about the short, medium and long term outlook for Toronto condos.

If, like me, you have the attention span of a goldfish, you can watch my video where I cover all this data below:

First up, let’s talk about what you need to know regarding the current state of the condo market:

- City-wide; condo prices are up 3-5% over October of last year – however, condo prices are down marginally versus the all-time-highs in February of 2020

- There is a considerable increase in long-term-rental inventory due largely to the flood of Airbnb units onto the long term rental market

- This flood of new inventory, and the lack of rental demand in the downtown core from international students, has caused rental prices in the downtown core to regress 8-15%

- For a point of comparison, rental rates for condos not in the downtown core (ex. Etobicoke or Peel) are only down 2-5% or so

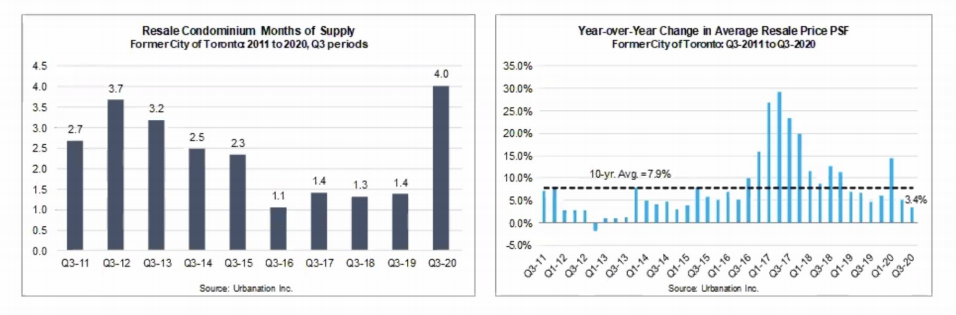

- We’re currently hovering around 4 months of inventory for Condos in Toronto – this is considered a balanced market (under 3 a sellers, over 6 a buyers market)

- Average Days on Market for a condo in Toronto in Q3 of 2020 was 20 DOM, by comparison, Manhattan is currently averaging 153DOM

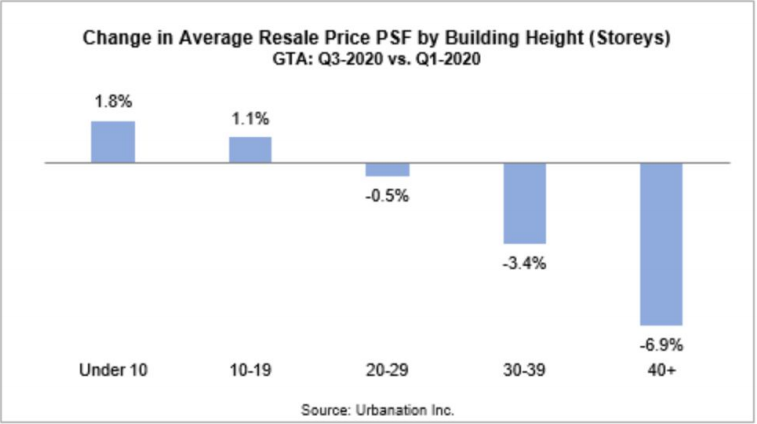

- Important note: market is highly fragmented right now. Larger units in boutique buildings, hard lofts, and units in the $1M+ category are doing very well, while cookie-cutter entry level condos in high-rise buildings are struggling

Do I think this is the bottom? No.

If you’d asked me mere hours ago, prior to Ford’s lock-down announcement, I may have given a more nuanced answer.

However, there’s a lot of inventory sitting on the market in the 30DOM+ category going stale right now – the question is, how far will prices fall before things turnaround?

My best guess: the market bottom is in the next 0-4 months, and prices for the average condo downtown may fall another 2-5% before trending in the right direction once again.

The truth is, a 2-5% correction from today’s prices is healthy consolidation and not something I’m overly concerned with – fact being, anyone who bought prior to mid-2019 will still be well into equity-positive at that level of correction.

If you recall, in 2017 we had a supply crunch in the condo market that led to over 25% appreciation in just one short year.

February of this year was looking remarkably similar to early-2017, when every average cookie-cutter condo unit under 800K was flying with multiple offers.

Covid has naturally taken the wind out of the sales, and that’s probably healthier for the long term market cycle here:

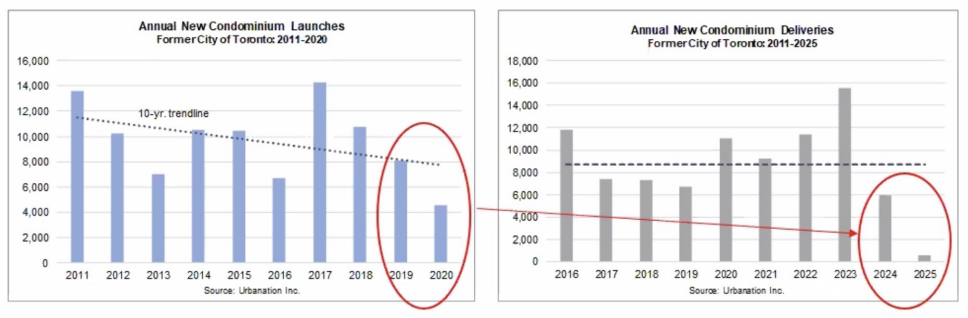

Pre-construction purchasing activity is down from this time last year but still quite active – given the rise in cost of construction, we anticipate any pre-construction launching in the near future to be at higher prices than previously launched product. If we take land transactions as a leading indicator, it would suggest most developers are bullish on housing right now.

However, many developers didn’t launch this year, and rather took the wait and see approach as you’d expect

I can tell you first hand that we only saw a fraction of the inventory we were anticipating on the pre-construction market this year. This will inevitably delay new housing completions, which will further strangle supply in an already under-supplied market

The 6 month and on outlook? Bullish.

In my opinion, of course – here’s some of my rationale and sources I think are worth looking at:

- The fact that small cookie cutter condos are struggling while large luxury units and detached homes are doing incredibly well tells me this is likely a short term shift in consumer wants, and an exogenous shock to the supply of units due to no tourism (airbnb) and no international students (long term rental supply)

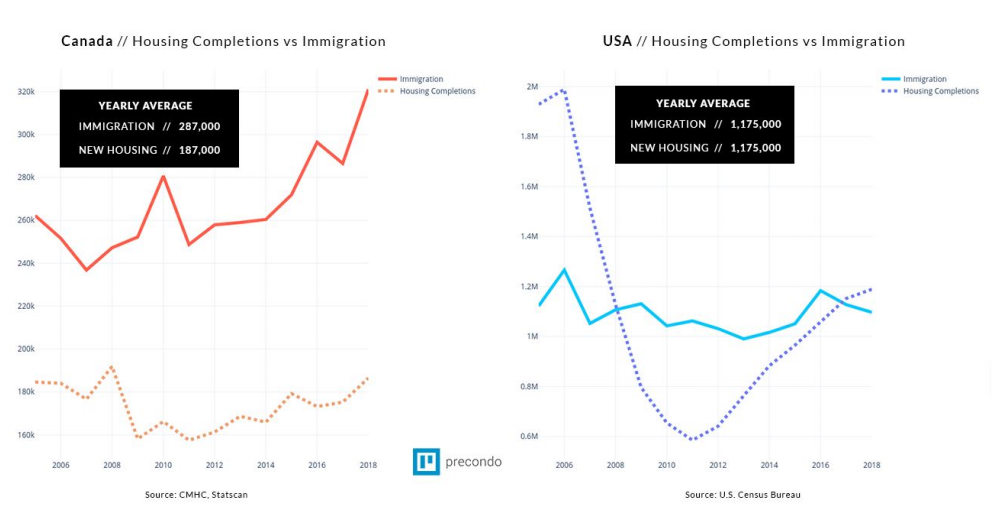

- The Toronto condo market was already severely under-supplied – while the number fluctuates depending on who does the math, anyone who does do the math comes to the obvious conclusion that we simply aren’t building enough homes to sustain our population trajectory. My video covers this here, and the Globe references a report on this here showing a short-fall of over 20,000 units per year over the next decade [1]

- The “mortgage deferral cliff” so many were talking about as a destabilizing force has gone by with little or no rise in defaults. Example: 99% of Home Capitals 9,900+ deferred mortgages have since resumed payment [2]

- Low rates are here to stay [3]. If we inflation average at 2%, but you can secure mortgage rates for even less than that, it goes without saying it will cause prices to rise in the housing market.

- Canadians are sitting on over $90B in excess cash [4]. CIBC’s Benjamin Tal suggests much of this capital will be deployed into Real Estate

And, perhaps, the most important point of the bunch: we’re targeting all-time-high immigration.

- The plan is to increase immigration targets to the most in a century – 401,000 in 2021, 411,000 in 2022, and so on. It’s no secret that 34% of that immigration lands in the GTA, and it’s the single greatest driver to our housing market

All this to say: short-term outlook is bearish. December is a very low volume month historically, so listings will sit and go stale. However, this year was going to be a 15% appreciation year prior to covid. The fundamentals supporting that haven’t changed, if anything, they’ve been bolstered. When the market turns, and it will, timing the bottom will be very difficult.

Questions? Comments? Leave em below!

Reach out to me at [email protected] with any questions.

Also stay tuned at Precondo.ca for the latest condo updates in Canada.