We’ve been getting a lot of questions lately about the market here in Toronto…

- will the stock market have an effect on the Real Estate market?

- will builders decrease their prices?

- should I put my buying plans on hold?

The truth is – we’re in uncharted territory and uncertain times. Nobody knows what’s going to happen next with any level of certainty.

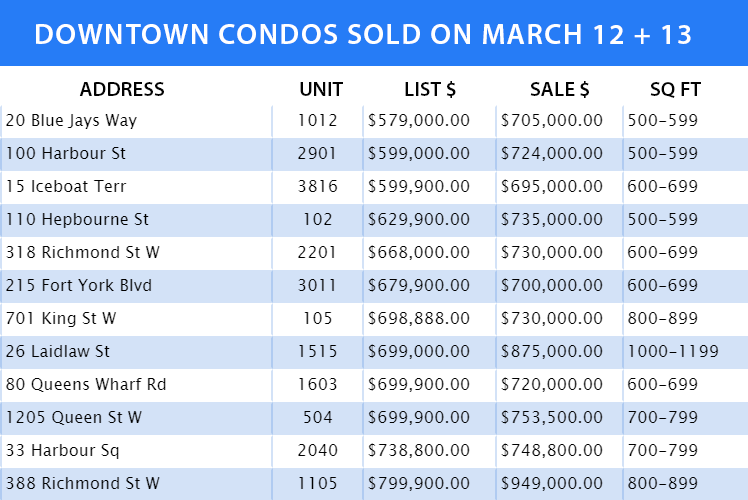

But, we’ll say this – so far there has been little change in the resale condo market. Resale condos are still selling in bidding wars for $100K+ over their list price regularly.

Here’s What We Know

Here’s what we do know based on historical market performance;

- The GTA housing market has been largely independent of the stock market for some time

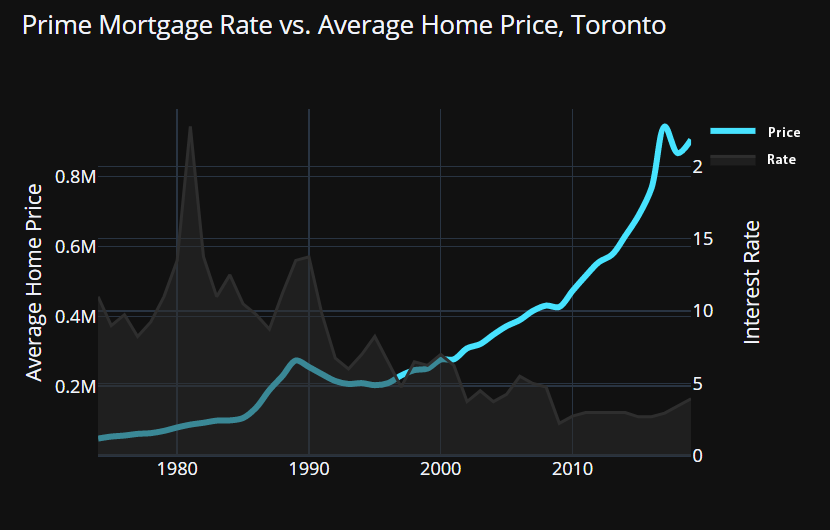

- Lowering interest rates historically increases housing prices

- Job loss does tend to limit demand and slow appreciation

- Inevitably, bidding wars will slow down and we’ll shift to a buyers market.

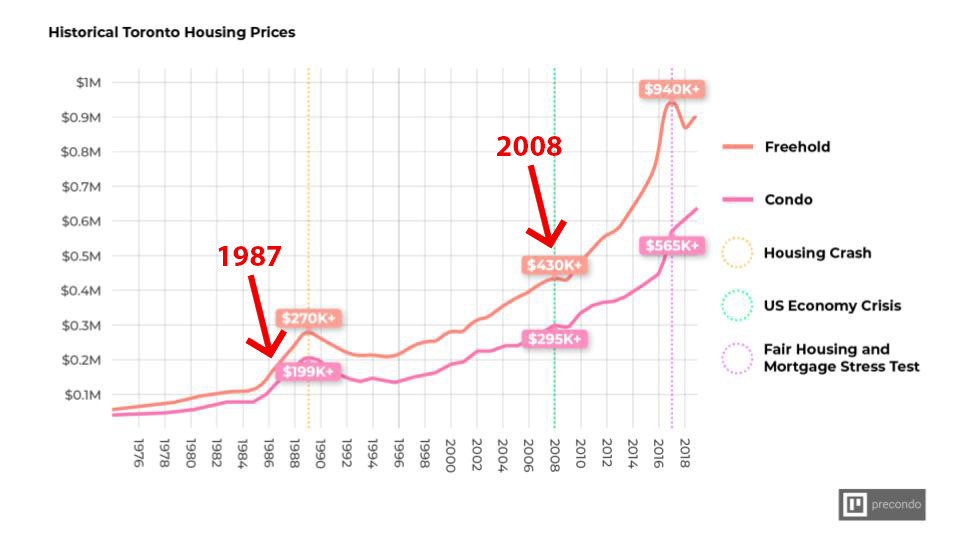

Important note here is that the 2008 Financial Crisis is not at all similar to the 2020 CoronaCrash in market indicators, fundamentals, performance or psychology.

The 2008 comparison is all over social media – but it’s not an apt comparison and shouldn’t be used to model what’s coming next.

A more accurate comparison would be to 1987’s “black monday” where the S&P dove 25% in a matter of days.

- 2008 was a slow burn into a recession caused by fundamentals (increased interest rates resulting in an steady increase in consumer defaults > bank defaults > economic collapse)

- 1987 & 2020 currently caused by black swan events (unexpected events) that result in emotional panic selling (don’t get me wrong – we have weaknesses; household savings rate at all-time low and corporate debt at highs, but there’s no reason for that to collapse with lowered interest rates)

And while we’re talking about stock market crashes – it’s worth taking a look at how housing prices were affected in ’87 and ’08:

Why Real Estate in the GTA Hold Its Own

There’s a number of reasons why Real Estate in the GTA tends to hold its own through stock market peaks and valleys:

- Property is a real, finite asset, and is considered a ‘safe’ investment by local and foreign capital. People will always need a place to live.

- The GTA’s housing market is driven primarily by supply and demand – we are immigrating and all time highs (demand) and new home completions (supply) has not been keeping up.

- Due to the supply and demand economics, Real Estate in the GTA has been untethered from wage growth for decades

- Historically speaking, Real Estate values double every eight to twelve years and tend to be less vulnerable to the downside when compared to the stock market (but typically slower appreciating too). I talk more about how real estate compares to stock market investment in the last 5-10 years in this video:

If we had to guess, this is one of the ways the next few weeks & months might play out:

- The pre-construction market will mostly pause as builders close their sales offices to the public and postpone any new development launches (already happening)

- The resale market might have some wind taken out of it, but will largely remain a sellers market with multiple offers on any nice inventory below 800K as people still need to buy and sell homes – regardless of the virus (still happening)

- When the virus has been contained (who knows when) the lower interest rates will remain for a while before being slowly increased – this will add fuel to the housing market fire

- For the patient ones – a buying opportunity in the pre-construction space may present itself when builders re-open and offer some extra incentives to jump start sales a bit and recoup for the lost time

- The fundamentals should prevail – supply will remain low while demand stays near all-time highs

Number #4 may be optimistic thinking on my part. It’s entirely possible that the pre-construction market picks up right where it left off and there is no “buying the dip” opportunity.

Our Thoughts on the Whole Matter

If you’re a motivated investor, the best time will always be yesterday and the second best time, today.

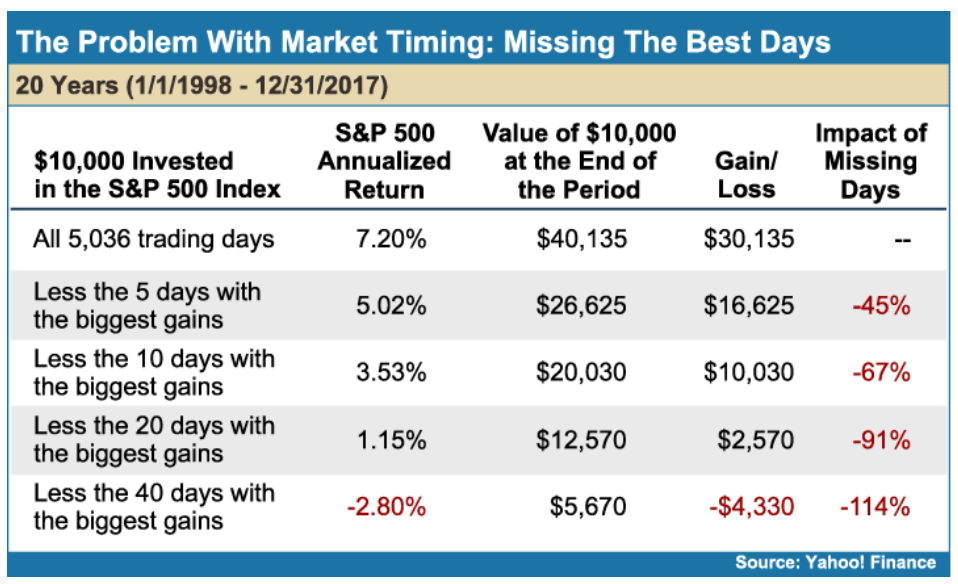

And on that note: trying to time the market is usually a horrible idea for the average investor.

Wanna hear something crazy? Fidelity did a study on all of their investor accounts a number of years ago to determine who performed the best.

Guess which investment accounts saw the greatest gains?

The investors who were dead & the investors who had forgotten about their accounts out-performed everyone else on average.

To drive this point home a little further here;

If you invested 10K in the S&P500 in 1998 and held to 2017 it would be worth $40,135

But, if you had missed out on the 20 best days out of the 5,000 trading days in total your investment would only be worth $12,570

While real estate is more protected from sharp declines like the stock market can experience – it’s upside works in the same way. You benefit most in real estate by holding for long periods of time.

Similar Articles:

What Should You Do?

If you’re a first-time buyer and you’ve been “looking for the right time to get into the housing market”, our advice is; now might be the time to start looking. It won’t get any less competitive than this. The more you wait, the harder it becomes for you to enter the housing marketing as prices are expected to appreciate faster in the future.

If you’re an investor and you’re looking at liquidating your properties to cover your stock market losses; our advice is, don’t. Instead, refinance at the lower rates and be patient in looking for a buying opportunity when sales centres open back up.

Basically – keep level-headed through this. Basing your decisions on fear of the unknown could lead you to lose out more in the long run.

This isn’t the first time the market has plunged this hard, and it won’t be the last. The investors who ignore the noise and hold for the long term outperform the rest.

If the market shut down for 10 years, would you be confident with your investment?

That’s how you should be looking at Real Estate as well – long term investing.

“the stock market is a device for transferring money from the impatient to the patient”

– Warren Buffet

Head over to Precondo’s homepage for more information on properties for sale, rent and pre-construction properties.