Planning to buy pre-construction condos? The good news is that condos make for a sensible purchase decision whether to live in or purely for investment.

Most investors opt for condos in the pre-construction market. Getting in early at the development stage is an exciting prospect, especially as you have a choice over the developer and location. So, the big question is what should first-time buyers look out for investment when the condos are in the pre-construction process?

Here are the top 7 things you need to know to ensure your condo investment is a sound one.

1. Invest In A Builder Before You Invest In A Building

This is a universal truth that I tell all my clients. Making a pre-construction condo investment becomes inherently less risky when you invest only in reputable builders.

Choose condo buildings developer or reputable builder who has a solid track record of executing on their development plans in a timely fashion and without excessive delays. The developer’s post-closing history is important when you want to make sure you get the best resale condo value.

This is also true if you want to resale condos as a business.

Remember that in such a real estate market, you’re purchasing the real estate based on a floor plan — a completely bare unit.

A) Did They Complete Their Buildings? How Delayed Were They?

Construction delays are inevitable with a pre-construction condo unit, it’s just how it is. Personally, I like delays. First off, the more the project delays, the longer time you have before you need to close on the brand new condo. All the while you’re leveraging the appreciation of the property market 5 to 1 (assuming you have 20% down, as with most pre-construction developments).

Secondly, if delay notices are handled improperly, which they typically are, you’re likely eligible for up to $7500. This is what’s known as a delayed occupancy rebate, and is thanks to Tarion.

The typical length of the delay is around 3 to 8 months from the initially marketed occupancy date. In my opinion, this is acceptable. However, if a developer’s past condo projects continually get delayed a year or more, that might indicate other issues. An example being poor financing.

B) Did Their Buildings Stand The Test Of Time? What About The Condo Maintenance Fees?

What real estate projects did the developer complete 5+ years ago? Are the projects in good standing financially today?

Long term success inspires confidence compared to a lack of data or experience. Investors understandably want to put their money in tried and tested ventures. As for the condo upkeep fees, look for red flags like special assessments or huge increases.

You’re looking for trends here, not outliers. Consistently good quality buildings, with good resale, and stable maintenance fees are all green lights for your preferred investment property.

2. The 10 Day “Cooling-Off” Period

The 10 Day cooling-off period is mandated by Ontario law on all new condominium purchases in the province. It gives you an advantage in this type of condo market that you just don’t have in Resale.

When you purchase a condo from a developer, you have 10 calendar days (cooling off period) from the date of signing to decide if you want the unit or not. Typically, builders increase most pre-construction condos prices regularly and change incentives as they open up sales to the public. The 10 day cooling period allows you to reserve the purchase price and the incentives. It also ensures the builder cannot sell the condo suite to anyone else or change the price on you.

There are two things I recommend doing during your ten-day cooling. The first one is to have a lawyer review your Agreement of Purchase and Sale with the builder. The aim here is to give you the scoop on closing costs & what the fine-print legal-jargon says. Secondly, take a look at other options. Go look at another comparable pre-construction condo project. Compare the prices and incentives to be sure you’re getting a good Toronto real estate transaction.

3. Interim Occupancy vs. Closing: What’s The Difference?

Interim Occupancy is when you get the keys and can move into your property – but technically, you don’t own your condo just yet. With condominiums, you have two ‘closing’ dates:

A) What Is Interim Occupancy For Condos?

The first is Interim Occupancy when you get the keys to your unit. Occupancy for owners is staggered, usually a couple of floors per week, that way everyone isn’t moving in on the same day.

At this point – the building isn’t registered yet. If you bought with a good builder, typically registration and the final closing will happen within 6 months after the interim occupancy period. Condo builders like Tridel are notorious for moving extremely quickly and efficiently to get their buildings registered quickly.

B) What Are Interim Occupancy Fees?

Interim Occupancy Fees are what you pay the builder to occupy the unit. You don’t have the title to your unit until registration, so your mortgage payments don’t start just yet. Some people call this “rent to the builder” or “phantom rent” – but simply put, it’s just:

C) Your Monthly Condo Maintenance Fees

Your condo fees start with the interest payment on the 80% borrowed for the purchase (assuming 20% down). The builder uses the Bank of Canada key rate to determine your interest payment, and the down payment is made to the builder directly.

During the time of interim occupancy, your monthly carrying costs will actually be lower than after registration. Other condo fees include maintenance fees for the general upkeep of the building and any facilities.

D) What Is Final Closing?

The final closing is when the builder registers the Condo Corporation with the City. This is when your bank pays the builder the 80% balance, when your mortgage starts, and when you receive the title for your unit.

This is also when final adjustments and closing costs will be calculated and paid. This includes factors such as property taxes, legal fees and land transfer tax. Plus any other costs as outlined by your Agreement of Purchase and Sale.

4. Closing Costs: Development Fees & Levies on Your Investment

If you’ve ever heard “Pre-Construction condo Horror Stories,” they were likely referencing some outrageously inflated closing costs that were levied against the buyer on the final closing.

However, they only happen to people who didn’t do their due diligence.

Now, the development fees and levies get determined when a property is developed. When a building goes up, the population density for the neighbourhood increases. The city is going to determine the impact on the neighbourhood. As a result, they will charge the builder a per-unit price. This funds the local infrastructure needed to support the residents that the building is bringing in. For example, new streets, parks, schools, future transit solutions, etc.

If your Agreement with the builder wasn’t reviewed by a good lawyer in the ten days, and you had an uneducated realtor guiding you, it’s very possible that your closing costs aren’t capped. In that case, if the City charges the builder $25,000-50,000 per unit, the builder will pass that cost along to you on the final closing. It’s critical to have a pre-construction realtor and lawyer on your side when you walk into the sales centre. The sales reps that work for the builder represent the builder, you need to have representation on your side.

5. HST Rebates For Investors On Condos

HST is included in the purchase price of the condo. If you’re moving into the property yourself, or one of your family members is, that’s all you need to know.

However, as an Investor, you need to be aware that on the final closing, you’ll be charged HST again. Without going into too much detail here, you can get 100% of your HST rebate if you file for it within 1 year and provide the government with a one-year rental lease agreement proving that you rented the unit out in the rental market. More on that in this video.

6. Assignments: Selling Pre-Construction Condos Before Closing

Assignments are your way out, or your way to cash out, of Pre-Construction units before the unit or building is actually complete. You call them assignments because you simply assign the Contract between you and the builder to a buyer – since no real property exists yet.

Assignment flipping is somewhat prominent but has slowed since the CRA decided that it may start applying income tax to the capital gains on an assignment sale. That’s if they determine your intention was to flip the unit before closing. Regardless, your right to assign is your way out of a pre-construction contract should life change. It also applies if you simply want to pull your profits and not close on the unit.

Many people try to assign their resale units themselves through Kijiji or word of mouth, but I highly recommend avoiding this route for a couple of reasons.

These include:

1. You’re unlikely to get fair market value. You may have to sell well below it to get any interest from low-traffic media like Kijiji and Facebook.

2. Assignment sales involve a lot more paperwork and legal headache than regular condo sales.

The bottom line is, you’re better off having a pre-construction realtor or team who specializes in assignment sales sell your unit for you (hint: we’re one of them). You have a far better chance of receiving fair value for your unit, and the commission paid will generally stand at minimal level compared to the price difference you’ll make versus selling it yourself.

7. Fair Market Value

“You can sell Pre-Construction Condos at a discount.” False. This refers to one of those assumptions that you toss around about as much as, “if I don’t use a realtor, the builder will give me a discount”.

The truth is – it depends on the unit, and it depends on the development. Some projects have its price at 5% under market value, while some have 10% above it. Sometimes, a project priced 10% under market value has a specific unit or two priced 10% over its resale market value.

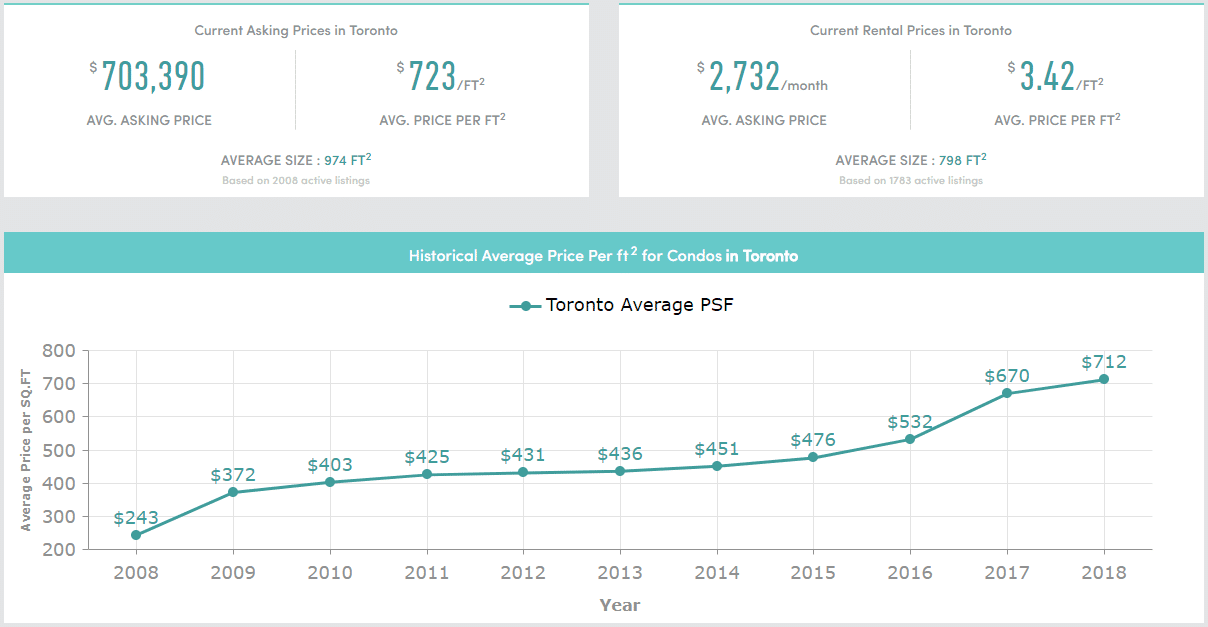

Buying a pre-construction condo with 20% down, or less, allows you to leverage 100% of the asset’s appreciation at a five-to-one ratio. Between 1997-2017, the 20-year-over-year average for properties in C01 (downtown Toronto) shows a near 11.56% appreciation before adjusting for inflation. Remember, Time In The Market > Timing The Market.

Is A Pre-Construction Condo A Better Investment Than A Single-Family House?

You’ll generally have to pay more to buy a single-family house compared with a condo as a house requires a lot more investment when compared to condos. Facilities such as playgrounds, pools, gym, etc. will not be pre-built in most houses.

So if you are wondering: “is buying a condo a good investment?”, the shorter answer here is yes. In the coming years, this investment will definitely pay you back.

So, Are Condos A Good Investment?

There are multiple factors that go into consideration when investing in a real estate property within the pre-construction market. However, when it comes to a condo investing, the features and amenities prove to have more importance when compared to an individual house. As a buyer, this makes new condos a very attractive proposition.

When you then factor in their excellent locations and transport links, it’s clear to see why condos are such a worthy investment. After all, we all need a place to live. Why not do so in some of the most stunning real estate your city offers?

Have questions about exactly what your condo investment should include? Explore the best pre-construction condos and newly built condos on Precondo.ca.

Hey there I’m really confused on the Toronto pre con Market. I was jus wondering if I would be making a mistake in purchasing a pre con 1 bed room unit for a price tag of 625k. Which in essence is roughly 1400sqf which seems kinda of high with comparable pre con developems in the city. I have recently looked into No 31 pre construction building by Lanterra developments. jus wondering if you have any advice. Is there money to be made in the long term with prices as high as they are. Any feed back would be greatly appreciated.